In this article, we will show you different ways to register customer deposits in Magaya.

There are different reasons why a customer must make a payment before billing and even shipping or carrying out the logistics operation.

The accounting regulations of each country should be considered, as some of the methods explained below may not be accepted in all.

Estas son algunas de ellas:

- Mi negocio no ofrece crédito.

- Los costos de la operación son altos y representan un riesgo.

- El cliente es nuevo y desconocido.

Si tienes otra idea, coméntala al final de esta página.

Here are the different ways to register customer advances

In Magaya and other logistics software with similar capabilities.

1. Payment record without invoice

This is the easiest way to do this process.

Here are the steps:

- From the payment list create a payment for the amount received from the customer

- By clicking OK, the system warns that a payment is being received without being applied to an invoice.

- When accepting again, the system generates a credit in favor of the client.

- If we go to the list of clients, we right click on the client and open the open transactions, we will see the payment there.

One of the advantages of this method is that these payments will appear in the statements of accounts of the clients and reports of accounts receivable.

To apply this deposit to a subsequent invoice, there are two ways:

- Once the final payment of the invoice is received (in this example the deposit is $ 1,000 and the invoice is $ 2,000), the invoice and the advance are selected, in that way the final payment will be for the balance only.

- The other option is to apply it to the invoice as soon as it is issued. This can be done in two ways:

- The payment where the advance was received is edited and applied to the open invoice.

- Or a new adjustment payment is created at $ 0 by selecting the advance (credit) and invoice, both for the same amount. In this way, the balance is netted.

Get ONE hour of FREE consulting.

In about 5 minutes on the phone, with a standard Magaya functionality, we were able to create a report for a client who spent about 8 hours a month filling out a spreadsheet, immediately saving him over $ 3,000 / year on that call alone.

From an accounting perspective, we can help you put a few pieces in place so you and your team can be more efficient.

2. Invoice from quotation

This option is perfect in those places where you can invoice and generate income, even if there are still no costs or logistics operations.

Here are the steps:

- From the initial quote, an invoice is created in the Actions button.

- When creating this invoice, it will not be linked to any operation.

- It can be sent to the customer to make a payment, either in whole or in part.

- Eventually, once the operation is finally created in the system (which can also be done from the quote), the invoice is linked to said operation, in this way the charges will now belong to the operation.

- Once the invoice is created, receiving payments will not create credits in favor of the customer.

We recommend creating tasks that allow you to remember the future link of these invoices to operations.

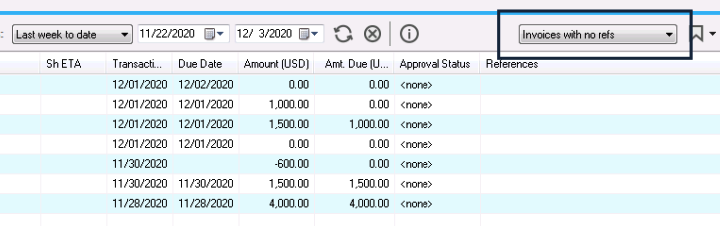

Another useful tool in Magaya is to create views with filters that allow us to see the invoices that are not linked to any operation, in this way we ensure that they will eventually be linked.

Everything we do as an accounting consulting firm is seeking efficiency for your business.

Every single area in your company has a direct impact on your books and that’s why we help you align them all.

3. Record as a liability

Unlike the first option in which we receive a payment without an invoice, thus generating a credit, which is a negative value of the asset (accounts receivable).

An advance payment can be recorded as a liability since we are receiving an amount for a service that we have not provided.

There are several ways to register it:

- A payment is created as in the first option.

- Enter the value in the Received Quantity field.

- Instead of saving it right away, we go to the Accounts tab, add a line, look for the desired liability account, select, add value and optionally choose the entity.

By saving the payment using this option, we will generate the credit to the liability account instead of to the asset.

Another alternative, very similar to the previous one, is to make an invoice affecting the liability account.

This option is particularly useful if the customer requests an invoice before paying the advance.

- The invoice is created.

- Instead of adding charges, we go to the Accounts tab, add a line, look for the desired liability account, select, add value and optionally choose the entity.

This invoice can be linked to operations such as shipments or warehouse receipts, but it will not make any difference to your operating profit.

Once the final invoice for the services is issued, the credit balance to this advance account must be debited for the same amount either from the invoice itself or from the final payment.

Visit our Accounting Services for Logistics Companies

Empower Your Inbox

Join hundreds who trust us for the latest insights and exclusive content.

Recent Comments