One of our most important missions at Innobo is to help our clients save money.

I many occasions the perception of savings is not evident until we account for the TIME that we spend doing recurrent tasks.

In this article, we will show you two examples of how we can help you save money.

In the meantime…

…Let’s get down to business with the Automated Depreciation.

¿What is Depreciation?

Is the fixed assets’ loss of value throughout the time for items such as vehicles, buildings, office equipment or machinery,

For the purposes of this article, we will only refer to the straight-line depreciation method.

How often do I have to record it?

There are three options:

Annual registration on purchase date:

That is, the depreciation expense and its counterpart are recorded as a credit to the fixed asset each year on the date of purchase of the asset. It is like a birthday that decreases your assets and increases your expenses every year.

Annual registration in the tax end period

Depreciation expense and its counterpart are recorded as a credit to fixed assets each end of the fiscal year (mostly December 31).

When the asset is purchased in the middle of the year, the proportion is recorded in the initial year and in the final year.

Monthly record

This option is our recommendation and the one that works best in Magaya and most accounting software.

The expense is recorded each month. In this way, we will always have financial statements closer to reality, and we will not fall into BIG annual depreciation expenses.

Get ONE hour of FREE consulting.

In about 5 minutes on the phone, with a standard Magaya functionality, we were able to create a report for a client who spent about 8 hours a month filling out a spreadsheet, immediately saving him over $ 3,000 / year on that call alone.

From an accounting perspective, we can help you put a few pieces in place so you and your team can be more efficient.

How to record the automated depreciation in Magaya (and most Logistics Software)?

This process offers two advantages: accuracy and automation

I. Recording the fixed asset purchase

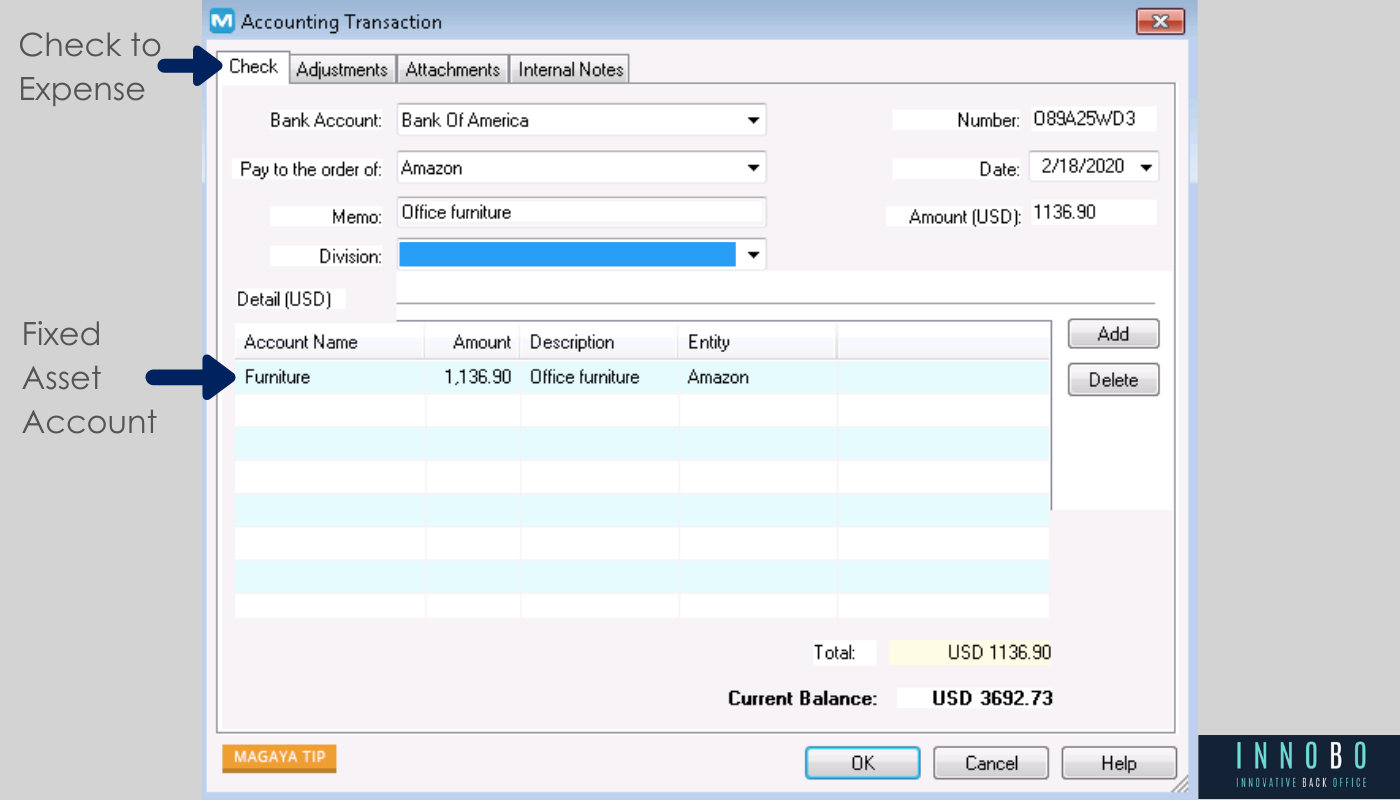

1. If the purchase was paid on receipt:

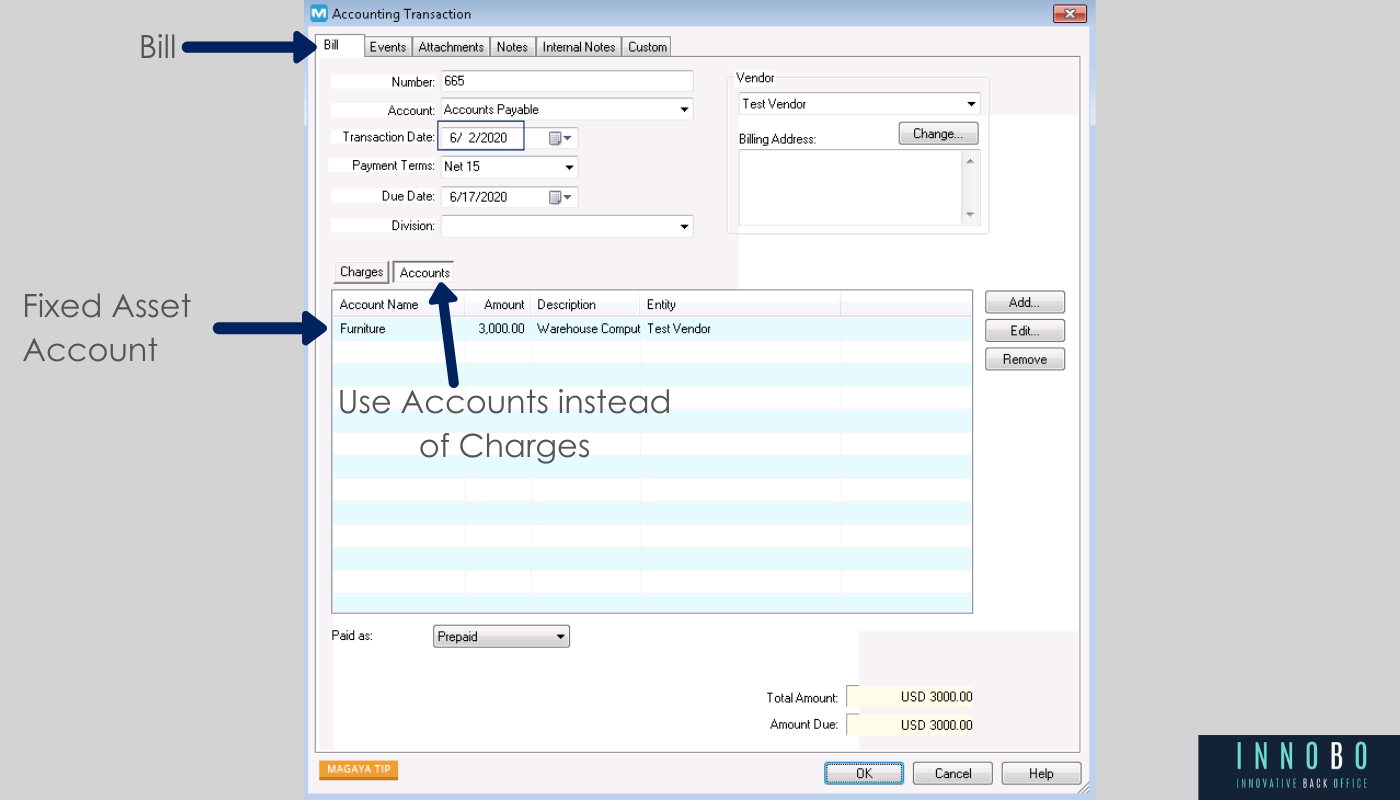

2. If the purchase is on credit:

II. Automated Depreciation Configuration

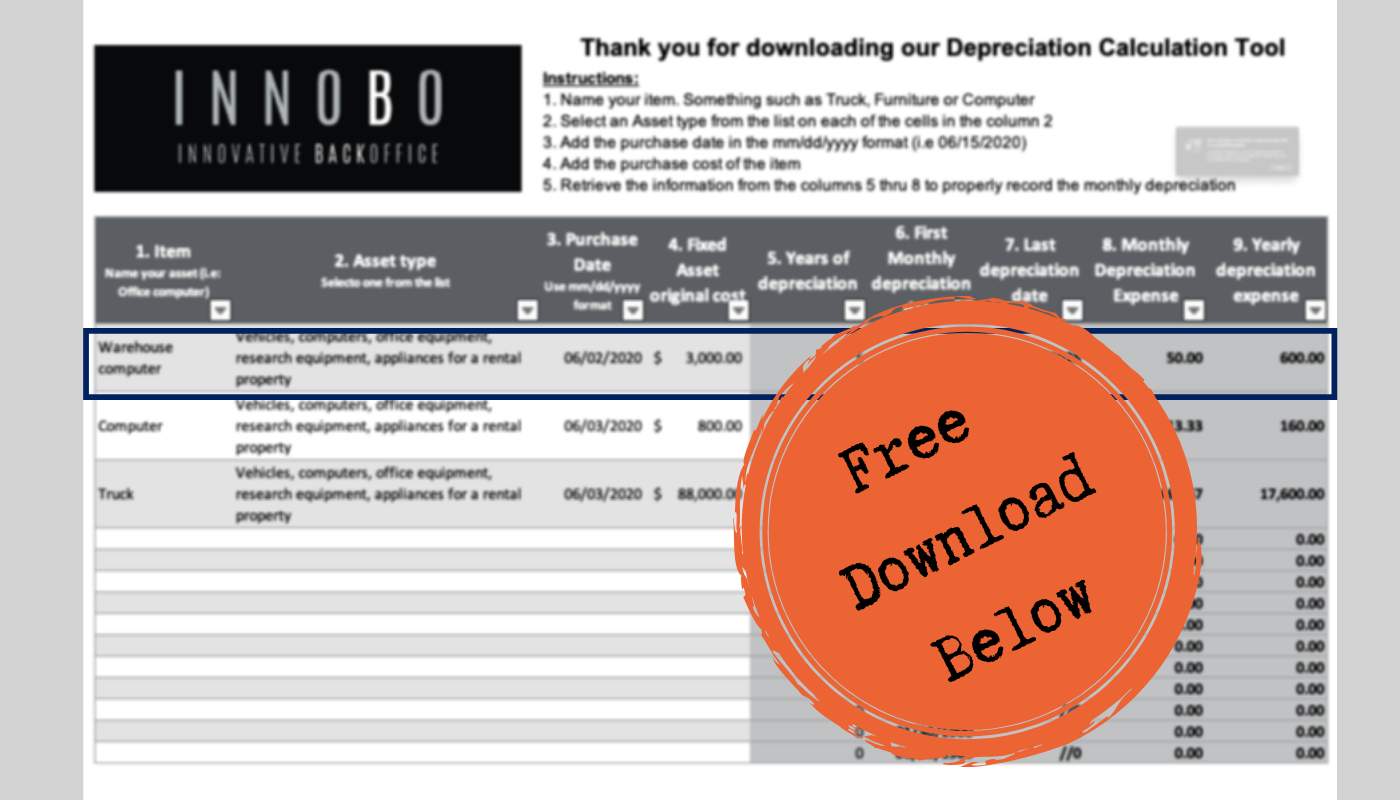

1. Calculation of depreciation

We have designed a spreadsheet that allows to:

- Calculate the depreciation time.

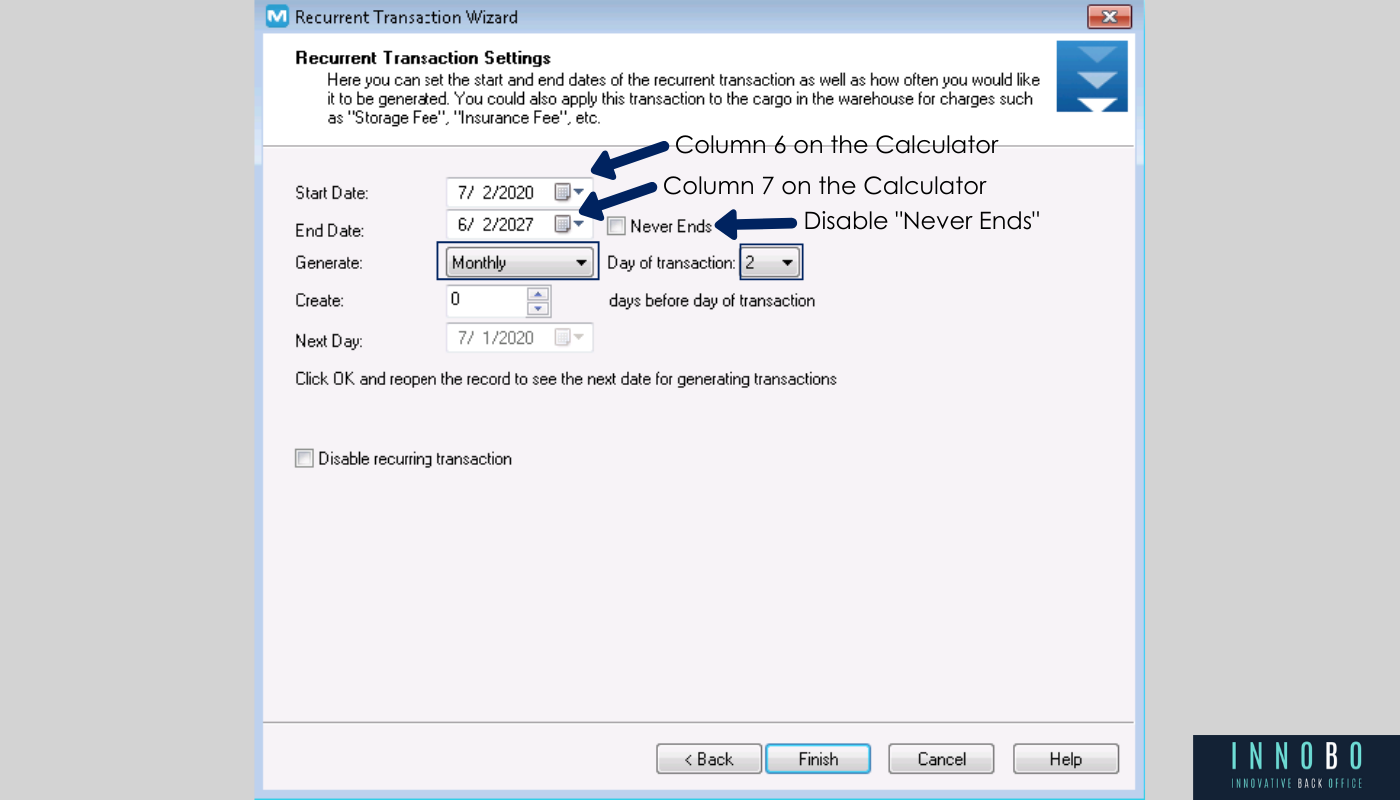

- The date of the first journal entry.

- The date of the last journal entry.

- The monthly or annual value of the depreciation expense.

2. Record of Automatic Depreciation

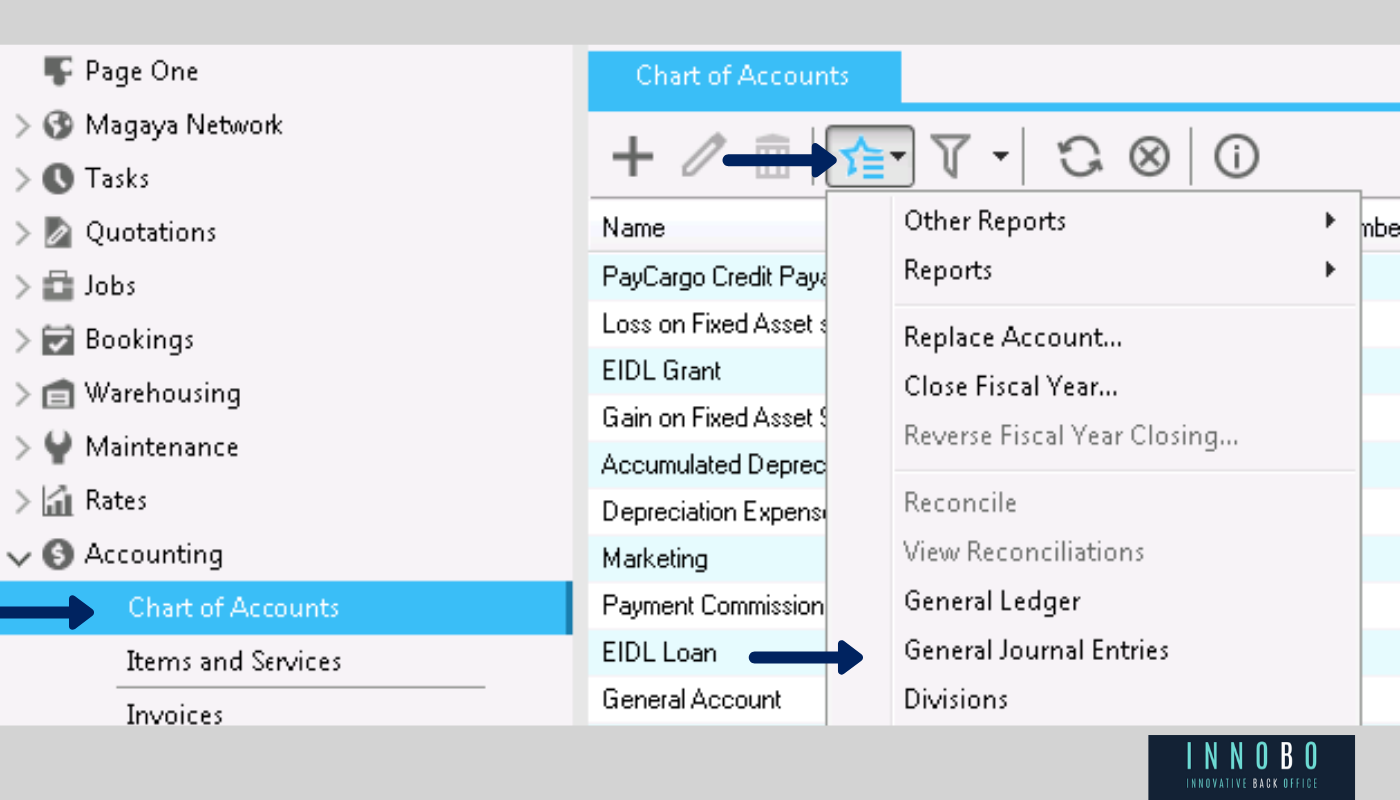

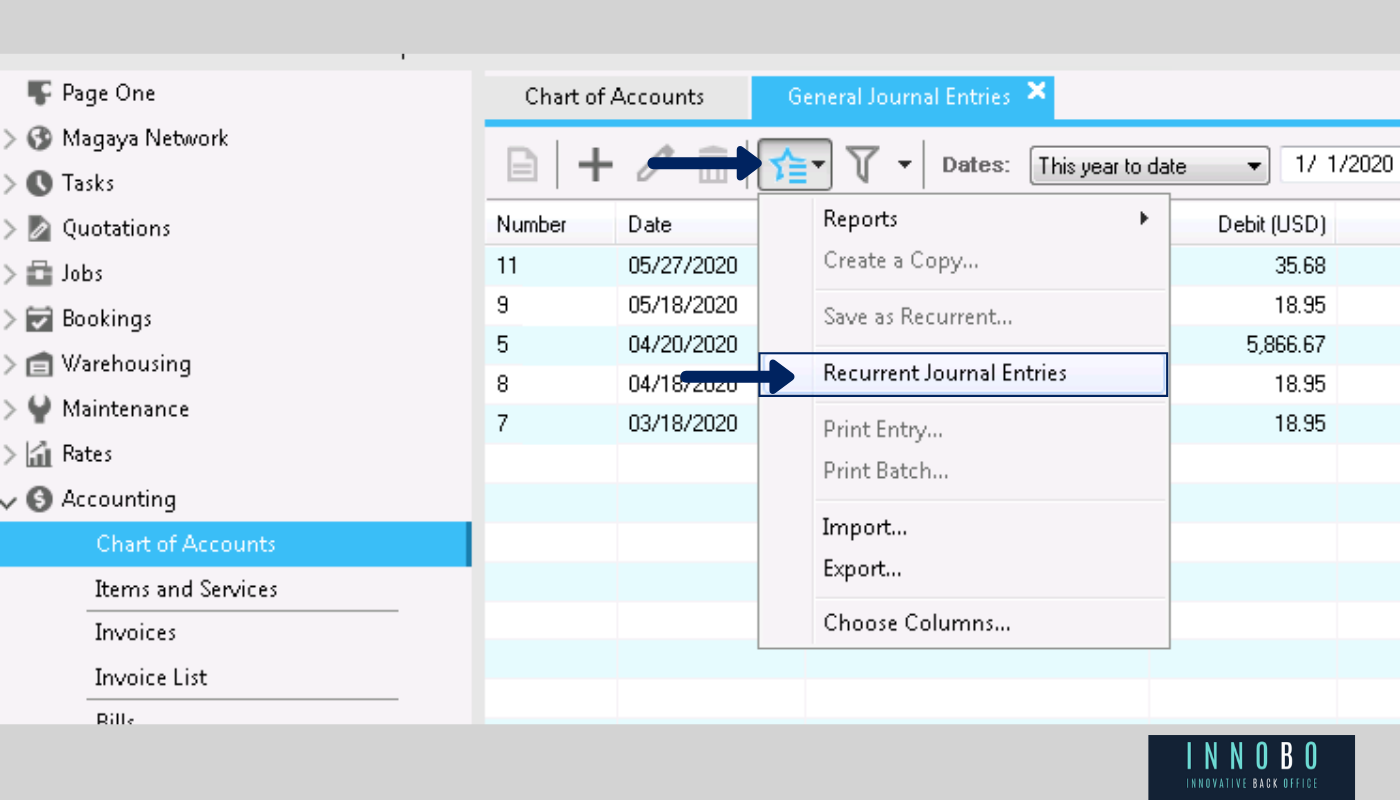

2.1. We go to the Accounting module > List of accounts > Actions > General Journal Entries

2.2. Within the Journal Entries list we go to Actions > Recurring Journal Entries

Everything we do as an accounting consulting firm is seeking efficiency for your business.

Every single area in your company has a direct impact on your books and that’s why we help you align them all.

2.3. Once there we create a recurring entry

- The date can be left on the day it is created.

- A description of the transaction is added to the notes.

- The number is left empty since the system will assign the corresponding one according to the numbering configuration for this transaction.

- Two account lines are added.

- The first will be the Depreciation Expense account and the monthly value that the Depreciation Calculator indicates in column 8.

- The second row will be Accumulated Depreciation (negative asset account) with the same value of the depreciation expense on the credit.

2.4. We’re done!

Once Finish is clicked, the system will continue creating an AUTOMATIC General Journal Entry every month, affecting these two accounts from the initial date to the final date programmed in the previous step.

This way, you won’t have to worry about this record anymore.

Remember to download our Depreciation Calculator to calculate the exact values and dates in a very simple way.

3. More recurring transactions in Magaya

Learn about all the recurring transactions that Magaya offers directly on their Knowledge Base here.

4. Depreciation in QuickBooks

Learn how to record depreciation in QuickBooks here.

Help us improve

It’s always exciting to get to know experienced people in the industry.

We’re not trying to sell or offer anything, but an expert’s input will help us create an offer that companies really want.

Book a feedback call, tell us what are the common challenges your company faces and get 2 hours of consulting for FREE.

If you are interested, please let us know what date and time work best for you next.

Visit our Accounting Services for Logistics Companies

Empower Your Inbox

Join hundreds who trust us for the latest insights and exclusive content.