In the logistics industry is very common to pay and receive money on behalf of third parties.

Third-party income and costs must be appropriately recorded, otherwise, we may incur unnecessary tax payments from excess income registration, or express unrealistic losses in our financial statements.

¿How to record these charges in software like Magaya?

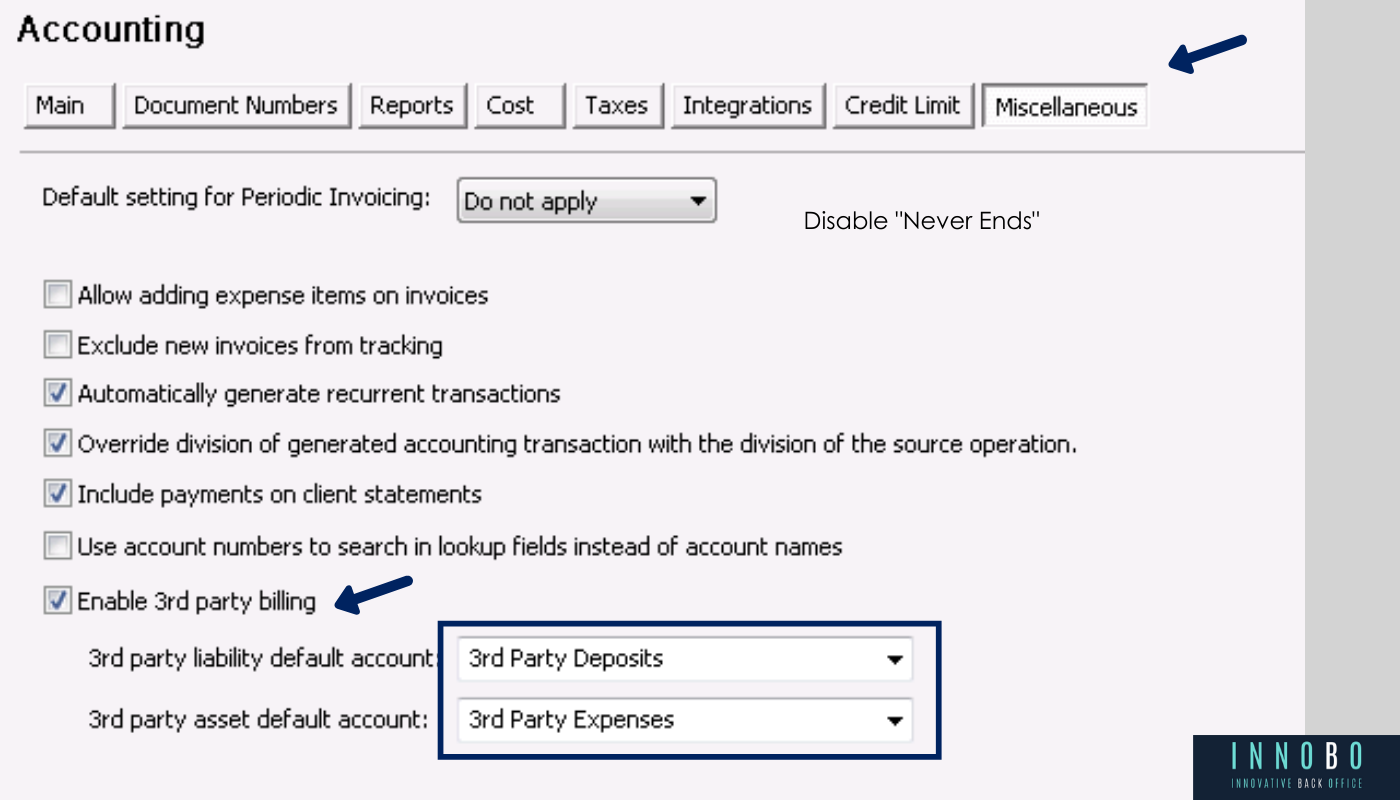

Most logistics software supporting accounting functions, such as Magaya, include an option to configure the asset and liability accounts already seen in the previous section.

On some occasions, it is sufficient to directly add a line with the account in transactions such as checks or deposits, but when we make an invoice or register an account payable, it is also important to ensure that the charges are affecting those accounts, and not the income or cost accounts.

Here you can see some configurations that will allow us to properly record these types of transactions:

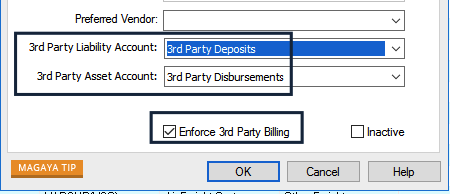

In the list of Charges

Edit the charges that are commonly used with 3rd party Income and Cost Accounts. You can even have the system always consider them as third-party charges, so you don’t have to worry about remembering to check the option on every shipment or transaction.

This option is very useful for charges such as customs taxes or port charges.

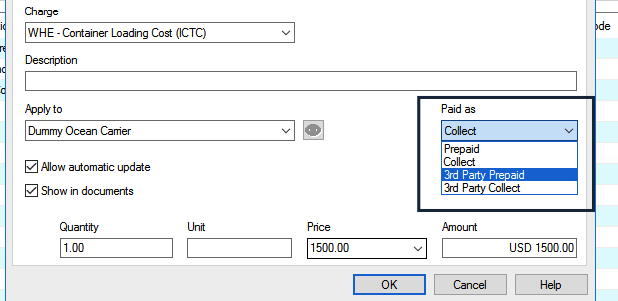

In shipments and other operations

Add the charges and use the Collect / Prepaid option to also choose whether it is a third-party charge or not.

When the charge is defined with the option to Force third-party billing, it is not necessary to do this since it will be marked by default.

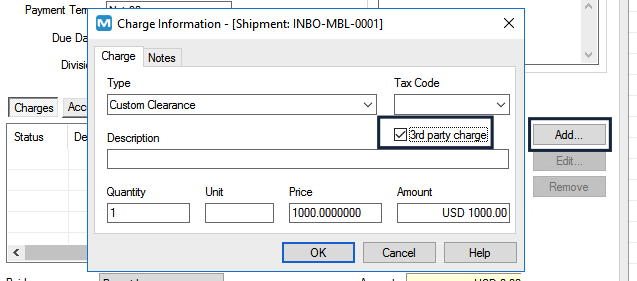

In the Collection and Payment Invoices

When adding an invoice simply activate the Third Party Billing box at the charges where applicable.

The system will automatically take these values to the corresponding Assets or Liabilities accounts, and not to income or cost.

This is how we help our customers save money

I had a call with a prospect who spent 3 years manually filling out an excel report that he sent to his agents at destination so they knew what the Collect and Prepaid Costs and Income had been, so they could calculate and pay the profit share.

He spent about 8 hours a month doing this, and as he said, “That reduced our ability to take on more clients because we kept busy making necessary reports.”

In about 5 minutes on the phone, we were able to create the report with him, with standard Magaya functionality, immediately saving him over $ 3,000 / year on that call alone.

Reconciliation & Reports

Unfortunately, Magaya does not allow shipping information to be shown in the Balance Sheet reports, which is where this information appears.

It does this in the Daily Journal report, but Operations related data will only be available in Accounts Payable and Accounts Receivable, so filtering won’t help much.

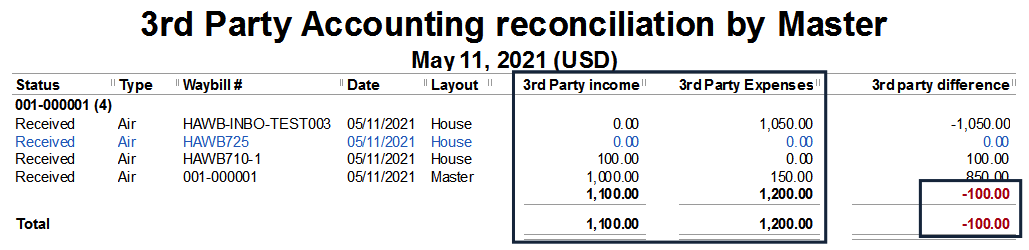

Innobo Customized Report

At Innobo we have developed a personalized report that will allow you to know exactly how much 3rd parties Income & Cost each of your shipments and consolidations has as shown below.

Let’s see some examples of how we can receive income on behalf of third parties, and how to pay expenses

Scenario 1

Context

- We are a freight forwarder or NVOCC.

- Our client is carrying out an import where we provide all the services at the destination.

- Merchandise must pay customs duty tax.

- We will make the payments of these (third-party) costs on behalf of the client (the third party).

Cash payment record

- A check is generated with a debit to the Third Party Cost account.

- This account is a current asset since in theory these funds will be recovered, it is an account receivable from our client.

Credit payment record

- An account payable is generated which charges must be recorded to the Asset account Third-Party Costs in the debit.

Scenario 2

Context

- We are a freight forwarder or NVOCC.

- Our client is carrying out an export where we provide all the services at the origin.

- Merchandise must pay customs duty tax.

- The client will deposit the necessary funds to us to pay those taxes.

- We will make the payments of these (third-party) costs on behalf of the client (the third party).

Customer payment record

- A Payment Receipt or Deposit is generated with credit to the Third-Party Deposits account.

- This account is a current liability, since in theory these funds will be paid and will not belong to us, therefore it is a debt.

Third-party cost payment record

- The procedure is exactly the same as seen in scenario 1. That is a debit payment to the Third-Party Cost account (active).

Billing our client

- An invoice is generated with a debit to the Third-Party Deposits account. This way, the account is brought to zero.

This is the second example of how we help our clients save money

Imagine that your Bookkeeper keeps a manual record of all your company’s fixed assets.

Every month, you should calculate the depreciation expenses of absolutely all the fixed assets that the company owns, and even if you have a good record of them, you have to be aware of the date of purchase and the final date of depreciation.

It sounds like a lot of manual labor subject to human error, doesn’t it?

With this method that we explain in this article, your bookkeeper will never have to worry about a calculation, record, or date EVER AGAIN!

View this article directly in the Magaya Knowledge Base

Help us improve

It’s always exciting to get to know experienced people in the industry.

We’re not trying to sell or offer anything, but we really appreciate an expert’s input in order to create an offer that companies really want.

So would you be open to a quick conversation in the coming days in exchange for free advising?

If you are, please let us know what date and time work best for you next.

Visit our Accounting Services for Logistics Companies

Empower Your Inbox

Join hundreds who trust us for the latest insights and exclusive content.

Trackbacks/Pingbacks